This is an edited version of my Sunday Times column from January 22, 2012.

Back in 2004, with much fanfare, Fine Gael launched its

ripoff.ie campaign that highlighted a large number of cases where

policy-related or regulated price structures and practices have resulted in our

cost of living falling well out of line with other Euro area economies. In

2009, Fine Gael launched a policy paper that was supposed to end Rip-off

culture, including in state controlled sectors, once and for all.

Fast-forward to today. Since elections, having abandoned its

pro-consumer agenda, Fine Gael has done marvellously in playing a ‘responsible’

possum to Irish vested interests.

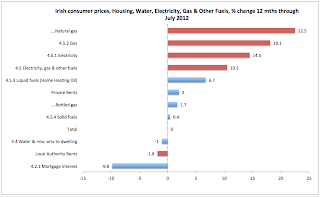

According to the CSO, year on year, consumer prices in

Ireland rose 2.5% through December 2011. The

range of these price changes across sectors, however, was dramatic.

Clothing and footware prices were up

0.4% in 12 months through December,

Furnishings, Household Equipment and Routine Household Maintenance prices fell

1.9%, Recreation and Culture deflated by 0.6%

and Restaurants and Hotels costs fell 0.9%. Health costs rose 2.6%, Transport

by 1.6%, Education by 8.9%.

Majority of these price hikes have nothing to do with

private firms ‘profiteering’. Per Purchasing Manager Indices, tracking the

changes in input and output prices for goods and services, Irish firms and MNCs

have experienced sustained shrinking of the profit margins since the beginning

of the crisis, as consistent with deflation. Instead, the largest price

increases, and ever expanding profit margins, took place in the sectors that,

in the past, Fine Gael have correctly identified as being state-controlled

parts of the Rip-off Ireland.

Food and non-alcoholic beverages prices are up just 5.9% in

the last 10 years, cumulatively. State-controlled Tobacco prices are up 69.6%

and Alcohol 21.6%. Housing, Water, Electricity, Gas and Other Fuels – single

largest category of consumer spending – is up 64.4% on December 2001, with 90%

increase in Energy Products costs, 63.3% increase in Utilities and Local

Charges, and 99.1% increase in Mortgage Interest costs. In the last five years,

Rents have fallen 8%, while Mortgage Interest rose 11.3% despite the fact that

ECB rates have dropped 2.5 percentage points over the period. Electricity

prices are up 28.3% in 5 years and 11.5% in the last year alone, despite the

fact that natural gas prices – the main generation source for Irish electricity

– have declined worldwide.

While Fine Gael cannot be blamed for the full extent of

price hikes since 2001 or 2006, the current Government bears responsibility for

failing to address state-controlled inflation since taking the office.

The above sectors are indirectly controlled by the state via

regulation, state ownership of banks and enterprises, and indirect tax

measures. But what about those costs more directly set by the Government?

Health costs are up 56.5% on December 2001, Education is up

81.5%. In Health, the core drivers of inflation have

been Hospital Services (up 40.2% since December 2001 and 9.8% in 2011), Dental Services (up 20.6% in 5 years, but

down 0.3% in the last 12 months). Meanwhile, prescribed drugs prices are down

11.3% on 2006 and 4% in the last 12 months. Health insurance costs are up 75.7%

and 22.9% since December 2006 and in the last 12

months, respectively. This in a country with younger population and well-established

trends in terms of demand for healthcare. In contrast, vehicles insurance –

privately provided and similar in predictability of total claims risks –

inflation since December 2006 amounts to just 9% and

0.9% in the last 12 months.

Same story of the state-led rip-off is replicated in the

Transport sector. Here, overall costs are up 9.3% in the last 5 years, but bus

fares are up four times as much. Privately controlled costs of buying vehicles

have declined 15.4%, while state-set motor tax rose 14.3%. Ditto in

Communications, where telecoms services costs are up 5.8% in the last 5 years,

but postal services up double that.

In two sub-sectors of education where the Government has

least power to influence prices – Primary Education and Other education and

training – inflation is the lowest. The highest price increases are in the

third level education, with prices up 50.1% in just 5 years (13.4% in last 12

months alone).

The above clearly shows that the Government and the

semi-state bodies and enterprises it owns, along with the banks are at the

heart of the extortion racket that is our cost of living. Over the recent

years, rapid deflation in prices and costs in the private economy has been

offset by the rampant inflation in prices and costs in the state-controlled and

regulated sectors. In majority of cases, this inflation was directly benefiting

state and semi-state employment, management and Government coffers. In all

cases, the costs were directly impacting Irish consumers who are left with no

meaningful choice, but to comply with the pricing structures set in the

markets.

CHARTS:

Sources: CSO database and author own calculations

Meanwhile, Budget 2012 clearly shows that the Government is

hell-bent on extracting ever-higher rents out of consumers through taxes and

charges.

For example, the Government has introduced increased

mortgage interest relief that amounts to €52 million in help for most

indebted-households. But the very same Government refuses to intervene in the

banks’ internecine policies of shifting the burden of losses from trackers onto

the adjustable rate mortgagees. The households that the Government finds in the

need of increased mortgage interest relief will be liable for the new Household

Charge. And, if Minister Noonan has his way, mortgagees who default on their

loans will pass into outright debt slavery to the banks.

There are more direct inflation-linked or inflation-raising

taxes, such as VAT. Increase in the VAT rate simultaneously pushes up the

overall tax component of all goods and services sold in the state that are

taxable at the higher rate (an increase in inflation of some 9.5% for those

items) and increases the costs of all goods and services that are dependent on

intermediate inputs. Excise tax on tobacco comes against the Revenue

Commissioners’ analysis showing that tobacco taxes have reached, even before

Budget 2012 measures are factored in, the point where higher taxes harm

receipts and fuel black markets. And Carbon Tax quadrupling from €5 per ton to

€20 per ton has been responsible for some 2% rise in inflation in fuel and

related activities. Motor tax increases, accounting for double the share in an

average household expenditure that accrues to bus fares, are going to directly

drive up the cost of transport.

Increases in State charges for hospital beds are expected to

raise the cost of healthcare for middle class patients by some €268 million in

full year terms. Health insurance levy hike further compounds this inflationary

grab-and-run approach to policy. Secondary education ‘savings’ are likely to

see parents being forced to cover much of the gap in funding out of their own

pockets. Third level measures, while relatively modest in size, will compound

massive inflation already accumulated in the sector over the last 5 years.

By the metrics of the Budget 2012, the current Government

didn’t just mothball its pre-election ideas on reducing the reach of the

State-sponsored Rip-off Ireland, it has actively moved to embrace the cost-of-living

increases through indirect taxation and encouraging avarice of the semi-state

commercial bodies and dominant near-monopolies. All of which means that the

path to economic recovery we continue upon is the path of deflationary spiral

in private sector economy, with mounting unemployment and businesses

insolvencies, offset by the unabated cost increases when it comes to the meagre

services the State does supply or control.

Box-out:

Following an almost 11% month on month decline in trade

surplus in October, Irish exporters have posted a record-breaking return to

health in November, bucking all expectations. The market consensus was for the

Irish trade surplus (merchandise trade only) to decline marginally to ca €3.4

billion in November. Instead, the trade surplus rose – on seasonally adjusted

basis – to €4.31 billion – the highest on record. In 11 months through

November, cumulative merchandise trade surpluses now amount to €40.53 billion

or 1.6% ahead of the same period in 2010. As before, the core drivers of trade

surplus were exports increases in Organic Chemicals, and Medical and

Pharmaceutical products, while indigenous exports rose significantly during the

last year in Dairy products category. The latest data highlights the resilience

of the Ireland-based MNCs’ exporting capabilities, providing continued contrast

to the majority of our counterparts in the Euro area ‘periphery’ who have been

posting dramatic slowdowns in exports and deepening trade deficits since the

beginning of Q4 2011.